Congratulations! Completing your Qualified Domestic Relations Order (QDRO) draft is a significant step in the process of dividing retirement assets following a divorce. However, your work isn’t done yet. To ensure the QDRO is properly executed and the benefits are distributed as intended, follow these essential next steps.

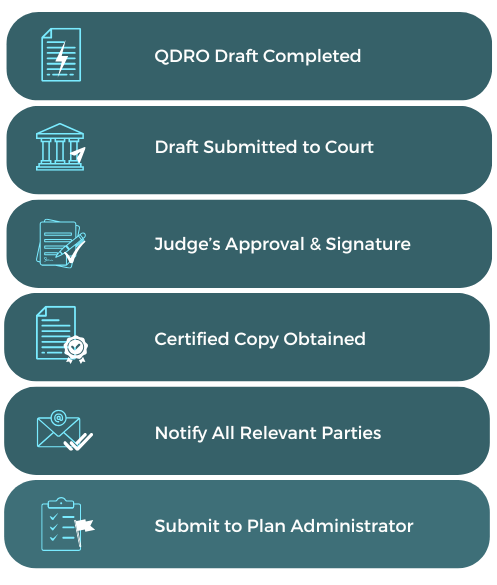

QDRO Draft Next Steps:

1. Review for Accuracy and Compliance

Before submitting your QDRO, carefully review the document to ensure it aligns with your divorce decree and meets the requirements of the retirement plan administrator. Errors or missing information can delay processing and potentially require costly revisions.

2. Obtain Court Approval

Once your QDRO draft is finalized, it must be submitted to the appropriate court (the court that issued your divorce decree) for a judge’s signature. This step officially validates the order and authorizes its enforcement.

3. Send a Certified Copy to your Plan Administrator

After obtaining the court’s signature, send a certified copy of the signed QDRO to the retirement plan administrator. They will review and process the order to divide the retirement benefits as instructed.

4. Notify All Relevant Parties

Once the QDRO has been submitted to the plan administrator, inform all involved parties, including your ex-spouse, your attorneys, and any financial advisors. Keeping everyone updated ensures transparency and helps prevent miscommunications or unexpected delays in the process.

5.Confirm Processing and Distribution

Follow up with the plan administrator to ensure they have received and accepted the QDRO. You should receive confirmation that the benefits will be allocated according to the order. Processing times can vary, so check in periodically if needed.

6. Plan for the Next Steps

Depending on how the funds are distributed, you may need to decide on payout options, rollovers, or tax considerations. Consulting a financial advisor or tax professional can help you make informed decisions about your share of the retirement benefits.

Final Thoughts

Completing your QDRO draft is a major milestone, but following through with these critical steps ensures the proper division of retirement assets. Taking the time to double-check details, secure court approval, and work closely with the plan administrator can help avoid unnecessary delays and complications.

If you need assistance with any part of the QDRO process, consider reaching out to a professional who specializes in retirement asset division. A smooth process now can help secure your financial future.